ENGIE Impact report: Australian Organisations scoring "quick wins" on decarbonisation but barriers to Net Zero remain

ENGIE Impact’s 2023 Net Zero Report finds that majority of Australian organisations are not meeting their ambitious decarbonisation goals.

SYDNEY, Australia – February 27, 2023 – Australian organisations have achieved most of the decarbonisation ‘quick wins’, but struggle with harder to address challenges due to major barriers, according to ENGIE Impact, a sustainability solutions advisory firm. The finding is based on analysis of data from ENGIE Impact’s latest Net Zero Report titled “Six Actions to Accelerate Decarbonisation."

The annual global report delves into corporate perspectives on decarbonisation transformation readiness, challenges to implementation and the major decarbonisation roadblocks companies must overcome to reach Net Zero. The study surveyed more than 500 senior executives from the world’s largest companies, each employing more than 10,000 people. Australian organisations surveyed ranged in annual turnover from USD$500 million to over USD$10 billion, and included businesses in the automotive, technology, retail, mining, industrial manufacturing, healthcare, real estate, and food and beverage industries.

"For most organizations today, the biggest barrier to effective decarbonization is not a lack of organizational will. Instead, the biggest barriers centre on the very practical implementation activities and decisions required to achieve meaningful decarbonization," said Jamie Ayers, ANZ Director, ENGIE Impact.

Strong commitment to decarbonise

Australian organisations seem to be among the most committed to science-based targets. The report found that 37 per cent of Australian businesses surveyed say they have a Net Zero science-based target commitment to reduce emissions across their entire value chain (Scope 1, Scope 2, and Scope 3). This is compared to the global average of just 16 per cent, and compared to just 19 per cent of their neighbours across the APAC region.

"Australia is setting a strong example of environmental leadership with its dedication to science-based targets. Many of its businesses have made a commitment to reach net zero emissions across their entire value chain, which puts the nation in a strong position compared to many global counterparts,” said Ayers. “Many Australians and pundits consider to Australia to be slow movers on sustainability initiatives, but this puts that unearned reputation to rest.”

Enacting Change with Financial Motives as the Core Driver

The report found that the drivers behind Australian decarbonisation goals and strategies are financial, rather than environmental.

Australian organisations rank achieving long term cost savings as the top driver of their decarbonisation strategy and goals (44 per cent of respondents), compared to the leading response from global counterparts in which “safeguarding the future of our planet” was the leading driver (47 per cent).

When asked “To what extent do you believe having a leading sustainability strategy with excellent execution will provide your company with a material competitive advantage versus your industry peers?”, 52 per cent of Australian organisations responded “a large extent” compared to 30 per cent of global peers.

These findings suggest that financial considerations are driving sustainability initiatives and discussions among Australian organisations.

"Economic motivations can be just as powerful a driver to enact change as the greater good," said Ayers. "Australian organisations may take a more pragmatic financial approach to change but the end result will remain the same as those driven by other factors: a more sustainable future both environmentally and economically."

Decarbonisation Journey Still Heavily Hindered by Obstacles

Only 19 per cent of Australian respondents believe that their execution of sustainability programs are meeting or exceed the ambitious goals set as many still face significant barriers when it comes to achieving net-zero readiness.

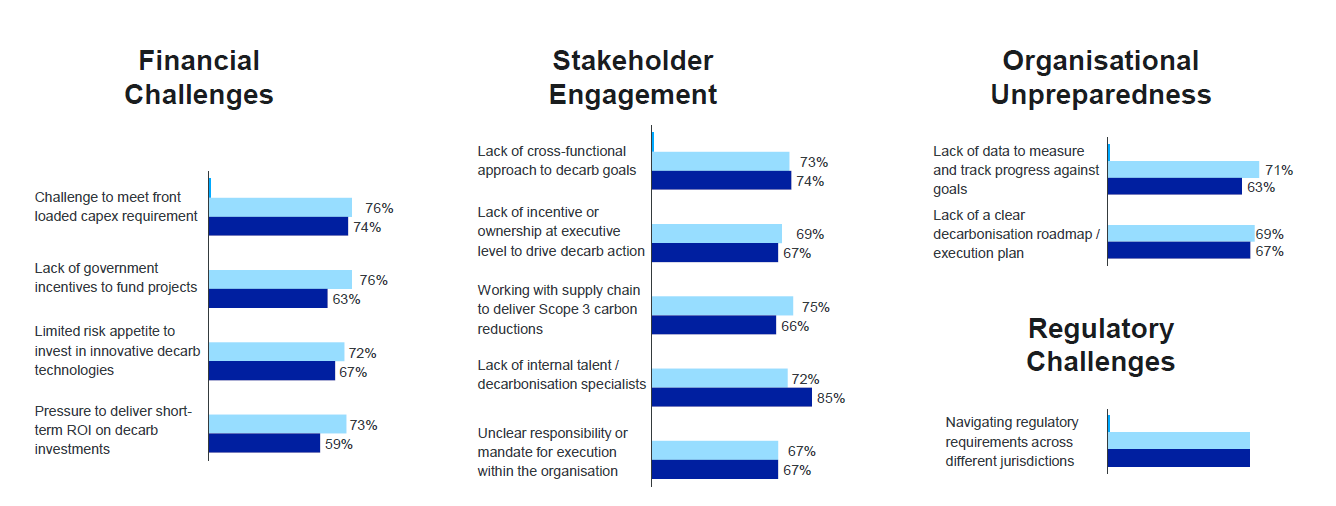

Navigating regulatory challenges remains a significant hurdle, with 70 per cent of businesses reporting difficulty in navigating regulatory requirements across different jurisdictions.

Stakeholder engagement is another area of concern, as 74 per cent of businesses cited a lack of cross-functional approach to decarbonisation goals, 67 per cent reported a lack of incentive or ownership at the executive level to drive decarbonisation action, and 66 per cent identified challenges in working with their supply chain to deliver Scope 3 carbon reductions.

Australian organisations also cited financial challenges, such as the difficulty in meeting front-loaded capital expenditure requirements (74 per cent of respondents), lack of government incentives to fund projects (63 per cent), and pressure to deliver short-term returns on investment (ROI) on decarbonisation investments (59 per cent), as posing obstacles."

Finally, organisational unpreparedness also poses a significant challenge, with 67 per cent of businesses reporting lack of a clear decarbonisation roadmap, and 63 per cent reporting a lack of data to measure and track progress against their goals.

“Businesses need to consider these challenges when planning their decarbonisation journey, and look for ways to address them – such as finding alternative funding sources, collaborating with other business and organisations or seeking expert help to navigate regulations, says Ayers.

Key Actions to Drive Success

The report summarizes six key actions companies and executives can implement in order to understand the gaps to Net Zero targets, overcome barriers to implementation and accelerate decarbonisation within their organisation.

The six actions include:

Maintain long-term focus and belief.

Establish governance and accountability.

Close the implementation expectation gap.

Increase executive accountability.

Activate the right decarbonization enablers.

Collaborate with the supply chains to address Scope 3 emissions.

The ENGIE Impact 2023 Net Zero Report

ENGIE Impact’s annual Net Zero Report identifies corporate decarbonisation readiness. The collective experience of the 505 organizational leaders in our 2023 Net Zero Report drills down on the most significant implementation barriers organizations are facing, and the approaches they are taking to overcome these challenges.

The report involved more than 500 senior executives from the world’s largest companies, each employing more than 10,000 people.

To read the complete ENGIE Impact 2023 Net Zero Report, please visit: https://www.engieimpact.com/insights/2023-net-zero-report.

###

About ENGIE Impact

ENGIE Impact delivers sustainability solutions and services to corporations, cities and governments across the globe. ENGIE Impact brings together a wide range of strategic and technical capabilities, to provide a comprehensive offer to support clients in tackling their complex sustainability challenges from strategy to execution. With 21 offices worldwide and headquarters in New York City, ENGIE Impact today has a portfolio of 1,000 clients, including 25% of the Fortune 500 Companies, across more than 1,000,000 sites. ENGIE Impact is part of the ENGIE Group, a global leader in the zero-carbon transition.

About ENGIE

Our group is a global reference in low-carbon energy and services. Together with our 101,500 employees, our customers, partners and stakeholders, we are committed to accelerate the transition towards a carbon-neutral world, through reduced energy consumption and more environmentally-friendly solutions. Inspired by our purpose (“raison d’être”), we reconcile economic performance with a positive impact on people and the planet, building on our key businesses (gas, renewable energy, services) to offer competitive solutions to our customers. Turnover in 2021: 57.9 billion Euros. The Group is listed on the Paris and Brussels stock exchanges (ENGI) and is represented in the main financial indices (CAC 40, Euronext 100, FTSE Eurotop 100, MSCI Europe) and non-financial indices (DJSI World, DJSI Europe, Euronext Vigeo Eiris - Eurozone 120/ Europe 120/ France 20, MSCI EMU ESG screened, MSCI EUROPE ESG Universal Select, Stoxx Europe 600 ESG, and Stoxx Global 1800 ESG).